News

Should you repair or replace? That’s always the big question when it comes to major home systems like air conditioning (AC).

Continue ReadingKeep your windows closed day and night. This will keep your home cool and prevent your AC from using more energy.

Continue ReadingAs with any heating, ventilation, and air conditioning (HVAC) system, you need to protect your investment. By neglecting regular maintenance, you will shorten your system’s life span and greatly reduce how well it functions, as our Hybrid Heating & Air Conditioning professionals witness quite often.

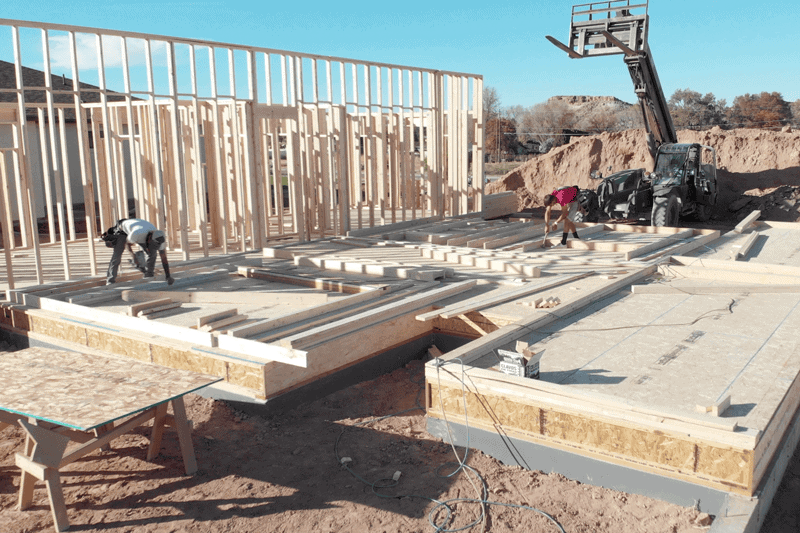

Continue ReadingBuilding a new home is an exciting adventure, but it can get overwhelming. That’s why our team is ready to step in and help you select the best possible heating and cooling system for your home and budget.

Continue ReadingHybrid Heating & Air Conditioning is happy to lay all the options on the table so you can make the best decision for your Hillsboro home. Here’s what you should know about dual fuel systems:

Continue ReadingYou turn on your heat pump, and you smell something burning. What should you do? Who should you call first, the fire department or your HVAC technician? First assess what the smell most likely is, and you may not need to call anyone. Of course, if you’re still nervous because you just don’t know, turn off your heat pump and give one of our highly trained technicians a call at 503-357-5663 to come out to diagnose the smell for you.

Continue ReadingOur team at Hybrid Heating & Air Conditioning could help you save big bucks on your monthly utility bill by performing a furnace replacement.

Continue ReadingYour home’s air ducts connect to your heating and cooling system, which carries all the air in your home. When you are breathing your home’s air, it is optimal for the traveling air to be as clean as possible, because it carries particles or debris that will settle in the ducts and carry it straight to you.

Continue ReadingIf you are in the market for a new heat pump, efficiency is probably a key factor in your search. The Air Conditioning, Heating, and Refrigeration Institute (AHRI) has a universal ranking system for heating and cooling units that serves to help.

Continue ReadingYour heating and cooling system is one of the most significant investments you’ll make in your home. Be sure to do some research before you buy anything to get the most value for your money. And make sure you are working with a company you can trust to do the job right.

Continue ReadingNeed HVAC Service?

Contact the experts at Hybrid Heating & Air.

Call us at 503-357-5663!